New York Attorney General Letitia Jay‘s office states it needs to hear testimony from former President Donald Trump and two of his adult kids to establish their knowledge about what investigators claim they have found to be numerous “misleading statements or omissions” in financial statements and tax submissions used to obtain loans.

Late Tuesday’s court filing stated that investigators “intend to make a final decision about who is responsible” and added that OAG “requires the testimony and evidence sought by this in order to determine which Trump Organization employees or affiliates — as well as which entities and individuals — may be able to assist the Trump Organization and Mr. Trump with making, and/or may have relevant information about, the misstatements, omissions, and other issues.”

They wrote that the “witnesses at the top of Trump Organization have asserted their Fifth Amendment rights to self-incrimination.” Others have claimed faulty memories or were following instructions from higher-ranking employees.

RELATED: Alvin Bragg, the new Manhattan DA, promises to put his efforts into Trump investigations

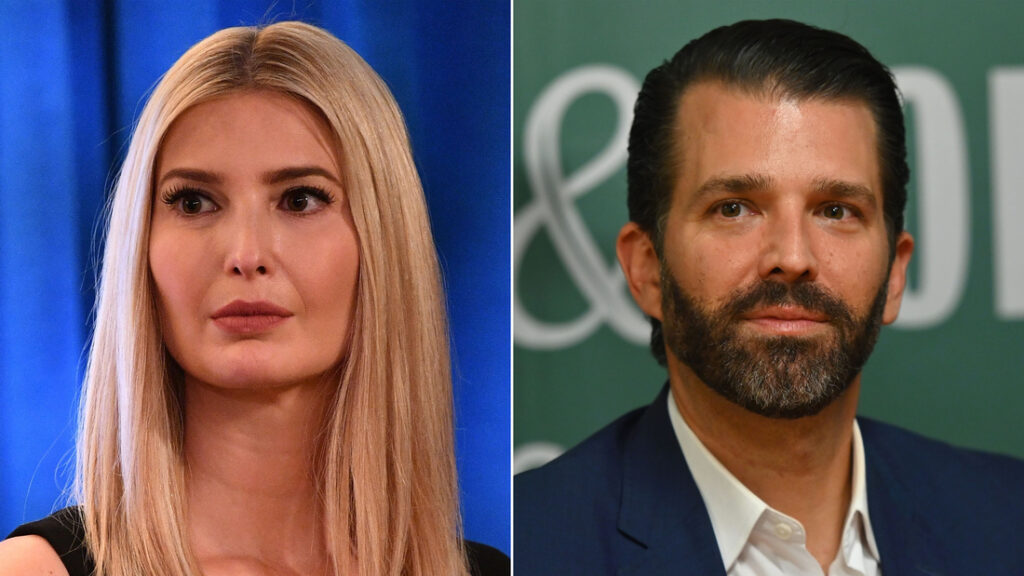

The filing states that Mr. Trump’s knowledge and intent to make the many misstatements and omissions is essential to resolve OAG’s investigation appropriately, in a just and fair manner. Donald Trump Jr. and Ivanka Trump acted as agents for Mr. Trump and supervised others in connection to the issues’ transactions. Their testimony is also necessary for OAG’s proper resolution.

CNN reached out to representatives of the Trump Organization and Trumps for comments.

Register your email address to receive the CNN “Meanwhile China” newsletter.

Ivanka Trump served as a liaison to Deutsche Bank. In addition, Donald Trump Jr. was involved with several properties, including 40 Wall Street. He also certified the accuracy and completeness of financial statements beginning in 2017.

Investigators claimed that around a dozen former and current employees of the Trump Organization testified and that Trump authorized the production of his tax returns.

The investigators stated that “in light of the persistent and repeated nature the misstatements, omissions, and it appears that the valuations contained in the Statements were generally exaggerated as part of an arrangement to suggest that Mr. Trump was wealthier than it otherwise would have been,” they wrote.

They also stated that Eric Trump and Allen Weisselberg (the former chief financial officer) testified to their Fifth Amendment rights against self-incrimination when they answered over 500 questions each.

The New York Attorney General’s Office stated that it is focusing on specific misstatements, including:

- Trump Tower penthouse size

- Trump misclassified assets that were not under his or the Trump Organization’s direct control as cash, thereby exacerbating his liquidity.

- The process by which Trump and his associates arrived at valuations was not disclosed. This included deviations from generally accepted accounting practices in ways that statements didn’t tell.

- It is inadequate to use fundamental valuation techniques, such as discounting future revenues or expenses to their current value or selecting only comparable properties to impute valuations from public data.

- It was misstated that “outside professionals” reached the valuations.

- We failed to inform you that an undisclosed amount exaggerated specific brand valuations.

James’ office asserts that Trump has not complied with subpoenas. They claim that Trump didn’t use email but that they could learn from witnesses that he kept hard copies of documents. Additionally, he used sticky notes to communicate his thoughts with employees. Finally, they claimed that a file cabinet containing Trump’s records wasn’t searched to comply with a subpoena.

They wrote, “This file wasn’t searched because the Trump Organization determined improbably that Mr. Trump wasn’t involved in the preparation his financial statements.”

James’ office stated that lenders shared the misleading statements and that insurers claimed that Donald J Trump received virtually all the benefits of the misleading valuations. According to the office, there is evidence that Trump may have received more than $5million in federal tax benefits due to allegedly misleading valuations derived from tax benefits at Trump National Golf Course in Los Angeles and Seven Springs in New York.

They wrote that a civil deposition is “essentially the same as a DANY deposition, but without the constitutional protections afforded to every witness through the grand jur process.”

Witnesses called before a New York state grand jury are granted transactional immunity and cannot be prosecuted unless the lie is under oath. They argued that James is trying to circumvent these rights by asking for testimony in civil cases, which criminal prosecutions could use. A jury could hold defendants responsible if they do not testify or draw an adverse conclusion in civil cases.

James’ lawyers argued that they could not assert the Fifth Amendment protections against self-incrimination.

“Each witness can invoke their Fifth Amendment privilege to protect themselves from self-incrimination. The attorneys stated that a witness’s right to invoke their Fifth Amendment privilege against self-incrimination in a civil investigation or other civil, administrative proceeding is not uncommon.